Expert Public Adjuster Services in Westmorland, CA | Accurate Claims

Public Adjuster Services in Westmorland, CA | Accurate Claims

In the “Gateway to the Salton Sea,” Westmorland property owners face a unique set of challenges. Whether you manage an agricultural facility near Highway 86 or own a home in this tight-knit desert community, your property is a significant investment. When disaster strikes, the insurance company sends an adjuster to look out for their bottom line—but who is looking out for yours?

At Accurate Claims, we are Licensed Public Adjusters who specialize in the Imperial Valley landscape. We work exclusively for you, the policyholder, to ensure that your claim is filed correctly, documented meticulously, and settled for the maximum amount possible.

Fire Damage Claims in Westmorland

A fire in our dry, windy environment can spread with terrifying speed. Even a small kitchen fire can leave behind pervasive smoke and soot damage that affects the entire structure.

Total Restoration: We don’t just settle for cleaning the char. We advocate for the replacement of compromised electrical systems and HVAC ducting to ensure your home is safe to inhabit.

Code & Ordinance Coverage: Most Westmorland properties require specific permits for fire restoration. We ensure your insurance company pays for mandatory upgrades required by the City of Westmorland Building Department.

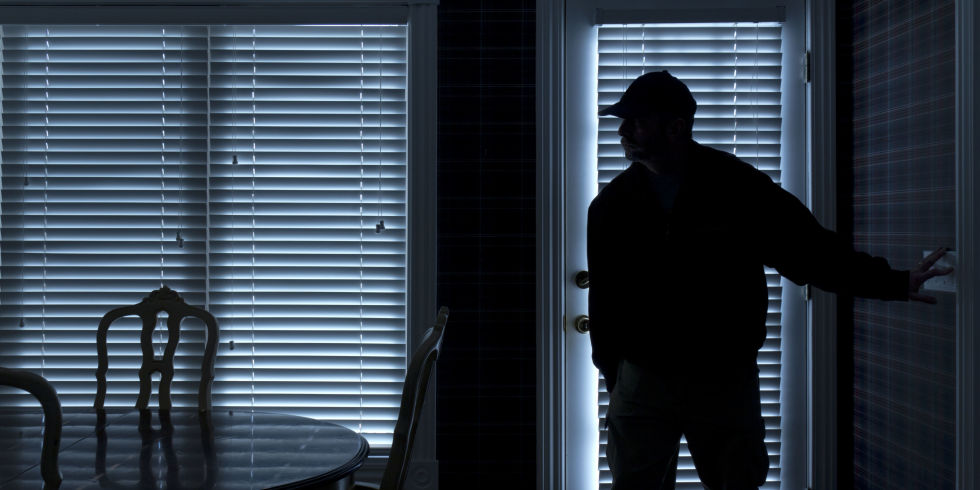

Theft & Vandalism Claims in Westmorland

A break-in or act of vandalism is more than just property damage; it is a violation of your space and security. In Westmorland, properties can be vulnerable to theft of copper wiring, agricultural equipment, or residential burglary.

Our Expertise: We assist you in creating a comprehensive inventory of stolen goods and documenting “resultant damage”—such as broken windows, smashed door frames, or ransacked interiors. We fight to ensure your settlement includes the full replacement cost of your items and the professional repairs needed to secure your property once again.

The Complexity of Theft: Insurance companies often demand exhaustive “proof of ownership” and may try to depreciate the value of your stolen items.

Water Damage Claims in Westmorland

Water damage in the Imperial Valley is a race against the clock. In Westmorland’s intense heat, a simple pipe burst or a slab leak can lead to rapid structural deterioration and secondary issues like rot in a matter of hours.

Our Process: Using advanced moisture mapping and thermal imaging, we document exactly where the water traveled. We ensure your claim covers professional structural drying and the full replacement of saturated materials to prevent long-term issues.

Geological Factors: The soil conditions around the Salton Sea can cause foundation movement when water is introduced. We look for the “hidden” damage that a standard adjuster might ignore.

Why Choose Accurate Claims for Your Westmorland Loss?

- Imperial Valley Specialists: We understand the local costs for labor and materials, ensuring your estimate isn’t based on “national averages” that don’t apply to our desert region.

- Decades of Experience: Our team brings over 30 years of combined experience in handling complex residential and commercial claims.

- Contingency-Based Service: We offer a free initial claim review. We only get paid a small percentage of the settlement we recover for you—if you don’t get paid, we don’t get paid.

- Unwavering Advocacy: We handle all the stressful negotiations, phone calls, and paperwork, allowing you to focus on your recovery.

Contact Us Today for a Free Claim Review

Don’t navigate the insurance maze alone. If your property in Westmorland has been affected by theft, vandalism, or a natural disaster, Accurate Claims is here to secure your future. We provide a free, no-obligation inspection and policy analysis to show you exactly how much your claim is worth.

Call us today or fill out our online form to schedule your free, no-obligation claim inspection!

Frequently Asked Questions (FAQ) about Claims We Receive in Westmorland, CA

Why shouldn’t I just use the contractor my insurance company recommended?

“Preferred Vendors” often have pre-negotiated rates with the insurance company, which can lead to “corner-cutting” to stay under budget. By hiring a Public Adjuster, you get a settlement that allows you to choose your own trusted contractor to do the job right.

Can you help if the insurance company already denied my water damage claim?

Yes. Denials are often based on an incomplete investigation by the insurance company’s adjuster. We can perform a new, more thorough inspection to find the “covered peril” that the insurance company may have overlooked.

Why shouldn’t I just use the contractor my insurance company recommended?

“Preferred Vendors” often have pre-negotiated rates with the insurance company, which can lead to “corner-cutting” to stay under budget. By hiring a Public Adjuster, you get a settlement that allows you to choose your own trusted contractor to do the job right.